Porinju Veliyath 12th April 2024

Dear Investors,

We have entered a new financial year and are also approaching an important political calendar in India; hence we are sharing some thoughts and reflections about the current and evolving investment landscape with our fellow investors.

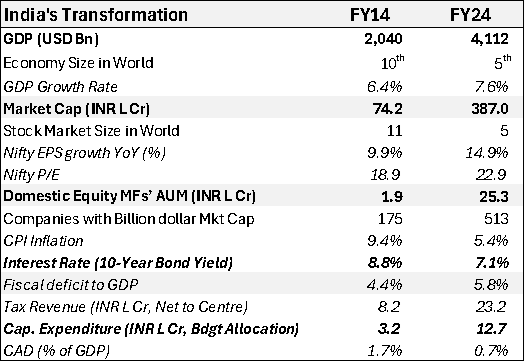

Snapshot of last 10 Years….

Indian economy has witnessed a strong foundational decade. Several path breaking reforms and policy initiatives have been initiated and ills of the previous decades in terms of fragile banking system and corporate balance sheet have been repaired. The economic growth is faster, inflation is tamed, corporate earnings are healthier and several capital market indicators are encouraging. Corporate balance sheet has never been healthier. Despite several global shocks (Covid, Ukraine War, Gaza Conflict, etc), India’s economic performance has been consistent. Government's massive push on building infrastructure, expansion of the manufacturing economy, rapid indigenization, digitalisation led productivity are some of the key drivers to growth. Long winter in capital formation in Indian economy is over and significant vibrant public and private investments are happening. This is in addition to India's traditionally deep consumption market, which is progressing from unorganized to organized at a population scale.

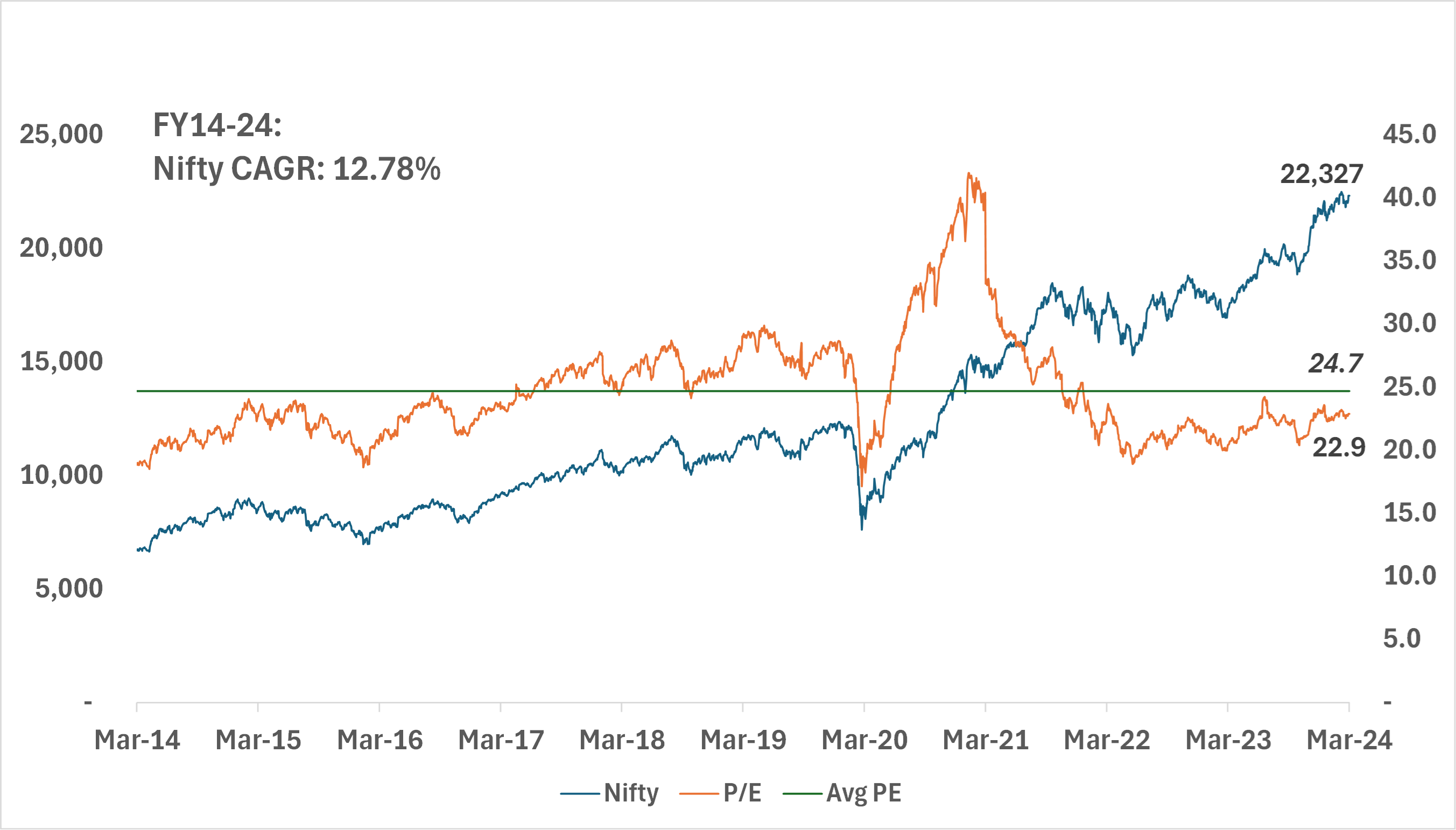

Despite all the buzz about euphoria, it should be noted that Nifty PE has hardly moved in last 10 years and earnings growth has been a key contributor in FY14-24 Nifty CAGR of around 12-13%.

To our perception, the past decade was more about steadying the ship and laying down some significant foundational building blocks of future growth drivers. Markets have behaved in line with several fundamental trends over long term, even though intermediate bouts of booms and bursts have occurred. Investors who have remained invested through several headline anxieties and worries have compounded wealth at a decent rate.

What about coming Elections?

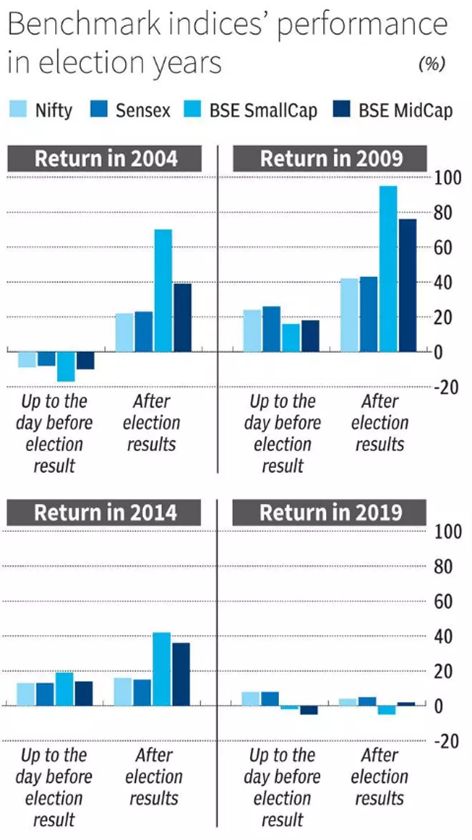

Investors tend to overweigh something current over something much more important and enduring. Elections are making headlines and investors tend to give too much attention to its potential outcomes.

We look at the past four elections and data shows that elections are becoming a non-event in the subsequent 12 months. Markets post event almost immediately gets anchored back rightly to the earnings prospects. Investors who enter or exit based on political anxieties have mostly felt regrets. Having said that several public polls and opinions of discerning political observers inform us that the current Government is most likely to retain power. And hence we see that the market is looking ahead towards a fresh set of impetus to economy immediately after the elections. We strongly believe that any portfolio exits at this juncture taken under political anxiety is not rational. At times, the only thing we must fear is the fear itself!

Coming 10 Years…

Indian economy has several structural drivers for economic prosperity, and we won’t be surprised if Indian economy reaches $8 Trillion by end of the coming ten years by 2034. Components such as demographic dividend, multiplier impact of historic infrastructure built up, deepening of financial sector, massive renewable energy sector investments, several manufacturing and services export opportunities, vibrant consumer markets and entrepreneurial spirit are all at play. Earnings growth should be as vibrant if not more than the past few years and we see 10 years CAGR of corporate profits to be around 12-15% range. With focused inflation targeting by RBI and prospects of stable interest rates, we see very healthy net returns potential of equity market for the next 10 years on back of improving earnings growth.

Corrections are Opportunities disguised…

As adept long-term investors, we recognize that market corrections are inherent to the nature of equity investment. Encountering an 8-10% retreat in market prices occasionally is not only anticipated but also indicative of a healthy market recalibration. We don't perceive these adjustments as hindrances; instead, we view them as good moments to augment capital infusion and fortify investment portfolios.

On the other end, constant paranoia anticipating market falls to get out and get in on time is mostly an exercise in regret. As Peter Lynch once said, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Commitment to Long-Term Wealth Generation…

Our investment horizon spans at least 3 to 5 years, during which we adhere to the philosophy that the essence of wealth creation lies in patient investment. The frequent realignment of our portfolio, in a bid to outguess market trends, is less likely to yield exceptional outcomes. Our focus is unwaveringly on identifying and investing in businesses with robust fundamentals and promising growth trajectories over the long term. As investors who prioritize long-term value, we are excited by the forthcoming opportunities Indian equity market offers. Stay Invested and look to buy more of Indian businesses in any market drawdowns.

With continued focus on our chosen processes, we are working harder to get better results for our investors, and are drawing inspiration from following words of Seth Klarman - "In the moment, public market investors have no ability to control investment outcomes, but they can control and improve their own processes... We believe that by remaining focused on following a well-conceived process, we will make good risk-adjusted, long-term investments. And we know that if we do that, we will indeed earn good returns over time."

Regards

Porinju Veliyath